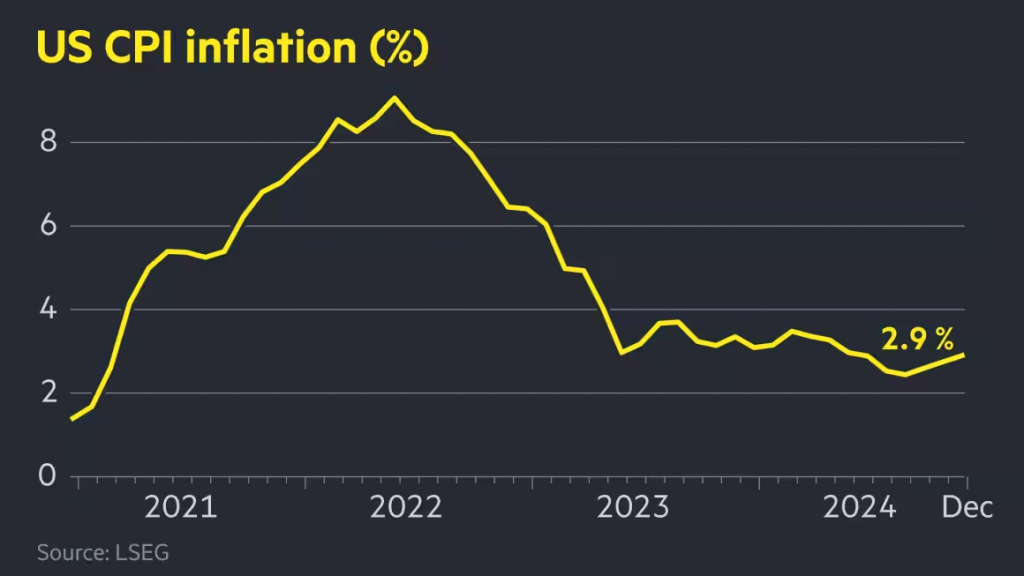

In December, the U.S. Consumer Price Index (CPI) report 2024 indicated a nuanced inflation landscape. The headline annual inflation rate rose to 2.9%, up from 2.7% in November. Conversely, core inflation, which excludes volatile food and energy prices, slightly decreased to 3.2% from 3.3% in the previous month.

Energy Prices Drive Headline Inflation

A significant contributor to the uptick in headline inflation was the energy sector. Gasoline prices surged by 4.4% in December, marking the largest monthly gain since August 2023.

Core Inflation Shows Signs of Easing

The modest decline in core inflation to 3.2% suggests a potential easing of underlying price pressures. This development has been positively received by financial markets, alleviating concerns about a resurgence in inflation.

Market Reactions

Financial markets responded favorably to the December CPI data. U.S. stocks and bonds rallied, with the S&P 500 and Nasdaq Composite experiencing gains of 1.4% and 1.8%, respectively. Additionally, U.S. Treasury yields fell, indicating increased investor confidence in the economic outlook.

Implications for Federal Reserve Policy

The CPI report has influenced expectations regarding Federal Reserve monetary policy. Investors are now anticipating potential interest rate cuts by July 2025, earlier than previous projections of September. Futures markets suggest an increased probability of multiple rate cuts within the year.

Sector-Specific Price Movements

- Shelter: The shelter index increased by 4.7% over the last year, marking the smallest 12-month rise since February 2022.

- Medical Care: Prices in the medical care sector rose by 3.1% annually, reflecting ongoing cost pressures in healthcare services.

- Education: The education index saw a 4.2% increase over the past year, indicating rising costs in the education sector.

Consumer Sentiment and Spending

Despite the mixed inflation signals, consumer spending remained resilient during the holiday season. However, there are emerging concerns about future inflation expectations. The University of Michigan’s gauge of consumer expectations for price rises over the coming 5 to 10 years jumped to 3.3% in the preliminary January reading—the highest since 2008.

Global Economic Context

The U.S. inflation trends are occurring amidst a complex global economic environment. In the United Kingdom, for instance, annual CPI inflation unexpectedly cooled to 2.5% in December, potentially allowing the Bank of England more flexibility in adjusting interest rates.

2024 CPI Report: Conclusion

The December 2024 CPI report presents a multifaceted picture of the U.S. economy. While headline inflation has risen due to energy costs, core inflation shows signs of moderation. Financial markets have reacted positively, and there is growing anticipation of potential monetary policy adjustments by the Federal Reserve in the coming months. Nonetheless, sectors such as shelter, medical care, and education continue to experience price increases, warranting close monitoring in the future.