In December 2024, Sweden’s annual inflation rate, as measured by the Consumer Price Index (CPI), decreased to 0.8% from 1.6% in November. This marks the lowest rate since December 2020 and the fifth consecutive month below the Riksbank’s 2% target.

Monthly Sweden CPI 2024 Movement

On a monthly basis, the CPI remained unchanged (0.0%) from November to December, following a 0.3% increase in the previous month.

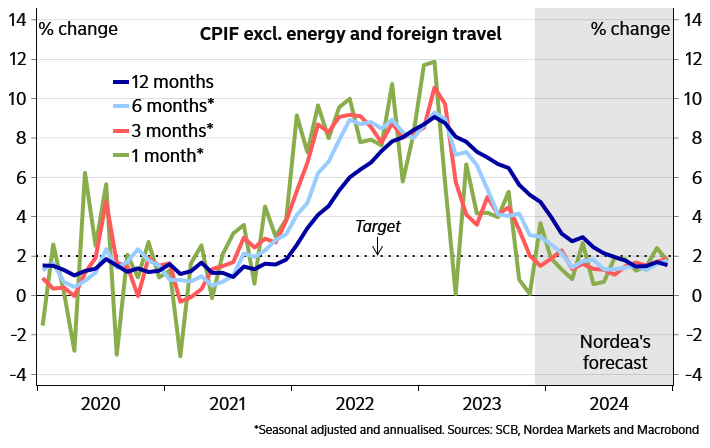

Core Inflation (CPIF)

The Consumer Price Index with fixed interest rate (CPIF), the Riksbank’s preferred measure, showed an annual increase of 1.5% in December, down from 1.8% in November. Monthly, the CPIF rose by 0.3%, a slowdown from the 0.5% increase observed in November.

CPIF Excluding Energy (CPIF-XE)

Excluding energy prices, the CPIF-XE recorded an annual inflation rate of 2.1% in December, a decrease from 2.4% in November. So, the monthly change for CPIF-XE was an increase of 0.4%.

Historical Context

Sweden’s inflation rate has shown a declining trend throughout 2024, averaging 3.04% over the year. Also, this is a significant reduction from the higher rates observed in 2023, where inflation peaked at 12.34% in December 2022.

Economic Growth Projections

The Swedish government has revised its economic growth forecasts, anticipating GDP growth of 0.6% for 2024, down from the previously projected 0.8%. For 2025, the growth forecast has been lowered to 2.0% from 2.5%. Inflation is projected at 1.9% for 2024 and 2.0% for 2025.

Implications for Monetary Policy

The sustained low inflation rates, particularly below the Riksbank’s target, may influence the central bank’s monetary policy decisions. The Riksbank might consider measures to stimulate inflation towards its 2% target, potentially through adjustments in interest rates or other monetary tools.

Conclusion

Sweden’s CPI data for December 2024 indicates a continued decline in inflation, reaching its lowest point in four years. This trend, coupled with revised economic growth forecasts, suggests a period of economic caution. The Riksbank and policymakers will need to closely monitor these developments. It also implement appropriate measures that support economic stability and growth.