Artificial intelligence (AI) and quantum computing are redefining the global landscape. But beneath the layers of software and code lies something more elemental: rare earth elements (REEs). These 17 elusive minerals are the raw materials that power the chips, magnets, lasers, and superconductors essential to emerging technologies.

Once considered niche and obscure, REEs have become the quiet enablers of global innovation—and now, the centerpieces of a growing geopolitical chessboard. Whether you’re talking about next-gen quantum processors, AI-driven defense systems, electric vehicles, or climate tech, these minerals are embedded in the very foundation of progress.

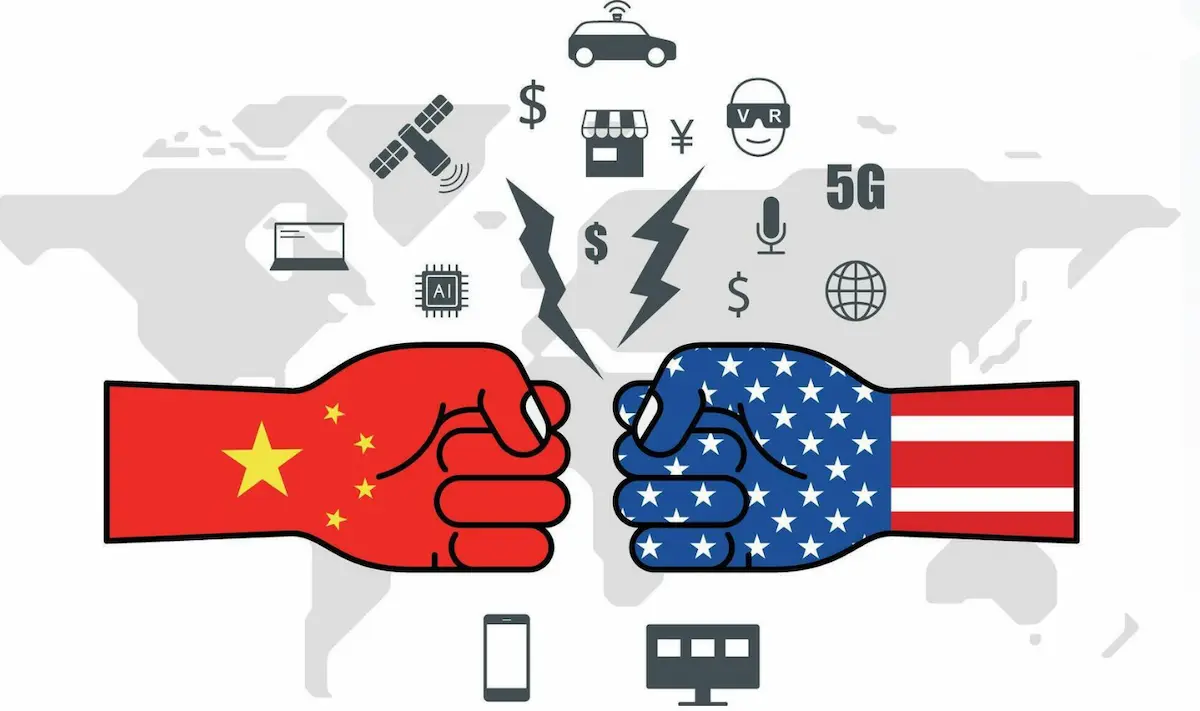

As the global power structure shifts from oil and coal to data and algorithms, the race for control over REEs is intensifying. With China commanding a near-monopoly over REE processing and the U.S. scrambling to build its own capabilities, the competition isn’t just technological—it’s territorial, economic, and deeply strategic.

In this blog, we dive into the intertwined future of rare earth elements and frontier technologies. Are REEs the new oil? Could they tip the scales in the AI and quantum arms race? And what role should ethics play in governing their use and distribution? Let’s explore.

Why REEs Quantum Computing Matter More Than Ever

AI and quantum systems require specialized hardware. Unlike classical computing, which can often rely on silicon alone, these new technologies demand elements like:

- Neodymium and Dysprosium: For high-performance magnets in servers, sensors, and quantum control systems.

- Yttrium and Gadolinium: For cryogenic cooling used in superconducting qubits.

- Europium and Terbium: For display tech and color stabilization in AI-integrated visual platforms.

As systems scale, the demand for REEs is projected to skyrocket.

| Sector | Estimated REE Demand Growth by 2030 |

|---|---|

| Quantum Computing | +700% |

| AI Hardware (GPUs) | +350% |

| EVs & Energy Storage | +400% |

| Defense Systems | +200% |

The Global REEs Quantum Computing Landscape: Who Controls What?

China currently holds the dominant position, mining and refining the vast majority of the world’s REEs.

| Country | REE Mining Share | Refining Share | Strategic Leverage |

|---|---|---|---|

| China | 60% | 85% | High |

| USA | 15% | <10% | Medium |

| Australia | 7% | 3% | Low |

| Myanmar | 5% | 1% | Vulnerable |

Efforts in the U.S. and EU to develop domestic refining and supply chains are underway, but timelines stretch into the 2030s.

Tech Giants and REE Dependencies

Leading corporations in AI and quantum sectors are exposed to REE supply risks. Here’s how:

| Company | REE Dependency Areas |

|---|---|

| Quantum chips (gadolinium, yttrium) | |

| NVIDIA | GPU magnets (neodymium, dysprosium) |

| IBM | Cryogenic cooling for qubit platforms |

| Tesla | EV drive systems, battery modules |

| Apple | Haptics, miniaturized speakers, color tuning |

Several of these firms are now lobbying governments for strategic stockpiles and supporting mining investments abroad.

REEs in the Military and Intelligence Complex

Beyond commercial uses, REEs are critical for national security. The U.S. Department of Defense categorizes REEs as essential for:

- Stealth technologies

- Directed energy weapons

- GPS satellites

- Secure quantum communications

The 2025 REE Defense Readiness Report estimates that over 95% of DoD advanced systems rely on Chinese-sourced REEs.

| Application | Critical REEs |

|---|---|

| Missile guidance | Samarium, neodymium |

| Drone systems | Dysprosium, terbium |

| Submarine navigation sensors | Yttrium, europium |

| Quantum-secure comms | Gadolinium, ytterbium |

Recent Escalations: Trade Wars and REE Restrictions

In April 2025, the ongoing U.S.-China trade war intensified with:

- U.S. imposing 125% tariffs on Chinese imports.

- China retaliating with 84% tariffs and restricting 7 REE exports to the U.S.

The result was a global market shock. Oil prices plunged, tech stocks tanked, and defense contractors raised alarms about material shortages.

| Market Reaction (April 10, 2025) | Change |

|---|---|

| OMXSPI (Stockholm) | –4.5% |

| Brent Crude Oil | –3.8% |

| S&P 500 | Largest drop since 1945 |

Can Innovation Beat Resource Dependence?

To reduce reliance on REEs, researchers are exploring:

- Synthetic alternatives for magnets and superconductors

- AI-optimized materials discovery to find novel compounds

- REE recycling from e-waste and defense equipment

The challenge? These technologies are still years from mainstream deployment.

| Innovation Strategy | Current Readiness | Key Barrier |

|---|---|---|

| REE Recycling | Moderate | Collection infrastructure |

| Synthetic Substitutes | Low | Performance & durability |

| AI Materials Discovery | Early-stage | High computing demand |

What the Future May Hold: Forecasting the Battle Lines

Analysts believe REE access could become the new measure of sovereignty in tech:

- Goldman Sachs: Predicts AI supply chain dominance will follow REE control.

- OECD: Urges allied nations to create a REE reserve akin to strategic petroleum.

- IMF: Warns that REE instability could delay green and digital transitions by 5+ years.

In other words, material control may outpace software prowess as the decisive edge.

Conclusion:

Swedish futurist and economist Mattias Knutsson outlined the moral dilemma facing world leaders:

“We’ve built a digital age on elemental fragility. If we hoard the atoms, we starve the system.”

Knutsson sees REEs not just as materials—but as moral fulcrums. He proposes:

- A global REE stewardship council led by democratic nations

- Investment in REE-neutral technologies like carbon-based superconductors

- Treating REEs as shared assets, not national trophies

His belief is clear: innovation without ethics becomes extraction.

“The winners of this era won’t just own the elements—they’ll redefine what we do with them.”

As AI and quantum capabilities explode, Knutsson urges us to ensure that our material foundations are just as forward-thinking as our algorithms.

REEs Previous Posts you might also like:

#Chapter 1:

- A Guide to Rare Earth Elements (REEs): Global Importance and Real-World Uses

- Where Are REEs Found and How Are They Mined?

- The Global Supply Chain and China’s Dominance in Rare Earth Elements (REEs)

Chapter 2:

- The Battle for Rare Earth Elements (REEs): Why Trump Wants Mining Rights in Greenland, Ukraine, and Canada

- Rare Earth Elements (REEs) Outlook: The Hidden Battle for Global Power and Innovation

#Chapter 3:

- Rare Earth Elements (REEs) in Ukraine and Kazakhstan: Untapped Potential or Future Powerhouses?

- The Global Quest for Rare Earth Elements (REEs) Deposits: Unexplored Frontiers and Emerging Hotspots

Chapter 4:

- Rare Earth Recycling: The Key to a Sustainable REEs Supply?

- Rare Earth Elements (REEs) and Global Supply Chain Challenges

- The Role of Rare Earth Elements (REEs) in Modern Technology

Chapter 5:

- The Critical Role of Rare Earth Elements in Quantum Technology

- AI Meets Quantum: How Rare Earths Power the Next Computing Revolution

- Superconductors and Rare Earths (REEs): The Key to Next-Gen AI and Quantum Computing

- Rare Earths (REEs) in Quantum Cryptography: The Future of Unbreakable Encryption

- Rare Earths (REEs) and Quantum Sensors: Redefining Precision Technology

#Chapter 6:

- Quantum Teleportation and the New Arms Race: Are We Ready for the Implications?

- Ethics vs. Innovation: Should We Pursue AI Self-Awareness and Teleportation While the World Burns?

- Will Control Over REEs Determine the Winners of the AI and Quantum Computing Era?