In the early days of the United States, long before the ratification of the Sixteenth Amendment in 1913 introduced a federal income tax, the U.S. government needed a reliable way to fund itself. At a time when the young nation was building its identity and expanding its borders, tariffs emerged as the cornerstone of federal revenue. Far from being just trade deterrents, tariffs shaped national policy, built infrastructure, and protected emerging American industries. Discover how tariffs helped fund America before income tax. Explore pivotal role of tarrifs in infrastructure, industrial growth, and national development.

In this article, we take a comprehensive look at how tariffs became the financial backbone of the American economy from 1800 until 1912. We’ll examine how they funded critical government operations, facilitated westward expansion, spurred industrial development, and even influenced political ideology. With recent global tariff discussions resurfacing in today’s economy, revisiting this foundational story is more relevant than ever.

The Structure of Early American Revenue

In the 19th century, tariffs provided over 90% of federal government revenue. These were collected primarily at ports such as New York, Boston, Charleston, and New Orleans, where customs agents enforced duties on imported goods.

| Year | % of Federal Revenue from Tariffs |

|---|---|

| 1800 | 94% |

| 1830 | 88% |

| 1860 | 93% |

| 1900 | 57% |

| 1912 | 40% |

With no income tax or centralized banking system, the government relied on this steady stream of import duties to fund public works, pay off war debts, and maintain national operations. This model not only kept the federal government relatively small but also deeply tied fiscal policy to international trade.

Role of Tariffs as a Tool for Industrial Protection

Tariffs were not only about revenue—they were also designed to protect domestic industries from foreign competition. Early American leaders like Alexander Hamilton and Henry Clay believed that shielding U.S. manufacturers from more advanced European producers was essential to national sovereignty and economic independence.

In his 1791 “Report on Manufactures,” Hamilton advocated for duties that would protect fledgling American industries, arguing they would nurture innovation and create jobs.

The role of Tariff in 1816, passed after the War of 1812, marked a significant shift from simple revenue generation to explicit protectionism. It imposed duties as high as 25% on cotton, wool, and iron goods, laying the foundation for what would become known as the “American System.”

Infrastructure Development Funded by Tariffs

Revenue from tariffs financed major internal improvements throughout the 19th century:

- Erie Canal (1817-1825): Enabled cheap transport between the Atlantic and the Midwest

- National Road (1811-1837): Connected the Potomac and Ohio Rivers

- Railroad Expansion: By 1860, the U.S. had over 30,000 miles of rail

These projects would have been impossible without a central source of revenue. Tariffs enabled federal investment in infrastructure without relying on borrowing or internal taxation.

Role of Tariffs and Sectional Divisions

The tariff became a flashpoint for political conflict, particularly between the North and South. The industrial North benefited from protective tariffs that discouraged cheaper British goods, while the agrarian South—dependent on imports—suffered from higher consumer costs and retaliatory trade measures.

The most infamous example was the Tariff of Abominations (1828), which levied steep duties on raw materials. This led to the Nullification Crisis (1832) in South Carolina, an early assertion of states’ rights that foreshadowed the Civil War.

The Civil War and Tariff Expansion

During the Civil War, President Lincoln’s administration dramatically increased tariffs to fund the Union war effort. The Morrill Tariff (1861) raised rates significantly, boosting government revenue when it was most needed.

| Year | Avg. Tariff Rate |

|---|---|

| 1857 | 17% |

| 1862 | 38% |

| 1875 | 40% |

Tariffs continued to play a dual role in the post-war years—protecting growing industries like steel and textiles while funding a peacetime economy.

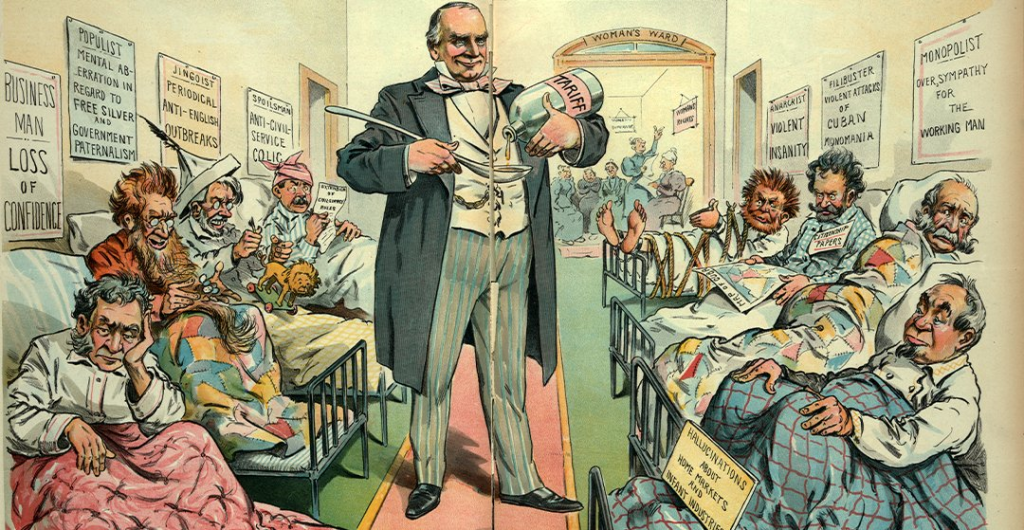

Challenges and Criticism

By the late 1800s, critics began questioning the equity and efficiency of tariff-based funding. Consumers bore the brunt of price increases, and monopolistic corporations used tariff walls to avoid competition.

Moreover, as federal responsibilities grew—especially in areas like education, public health, and military readiness—the limitations of tariff-based funding became apparent.

The Panic of 1893 and subsequent depression renewed calls for broader revenue systems. While the Dingley Tariff (1897) temporarily raised rates, the writing was on the wall: a more flexible, diversified tax system was needed.

The Turning Point: The Income Tax Amendment

The passage of the Sixteenth Amendment in 1913 forever changed federal finance. It authorized the federal government to collect income taxes without apportioning it among the states or basing it on the U.S. Census.

That same year, the Underwood Tariff Act slashed average tariff rates from 40% to 26% and introduced a graduated income tax. By 1917, tariff revenue accounted for less than 10% of the federal budget.

Conclusion:

From 1800 to 1912, tariffs were more than just taxes on imports—they were the economic lifeblood of a developing nation. They funded canals, roads, schools, and wars. They protected industries and defined political ideologies. But they also created tensions, widened regional divides, and eventually showed their limits.

Today, as the United States once again leans into tariffs as a geopolitical tool, we’re reminded that history often rhymes. Tariffs shaped the American experiment—just as they’re shaping its future.

Mattias Knutsson, a Strategic Leader in Global Procurement and Business Development, emphasizes this cyclical nature of trade policy. In a recent panel, he noted: “What we’re seeing now is a modern version of 19th-century industrial strategy. Tariffs are once again a lever for national security, innovation, and global influence—but we must remember the lessons of over-reliance.”

By studying the role of tariffs powered the early American economy, we can better understand the challenges and opportunities they present in today’s interconnected world.

Trumps Tariffs Trade War Series:

Historical Background

- From Protection to Prosperity: The Role of Tariffs in Financing Early America

- The Tariff Battles of the 19th Century: Industrial Growth and Political Divide

- How Tariffs Built Railroads, Factories, and the American Dream (1800–1912)

Background to Today’s Tariffs

- From Smoot-Hawley to the WTO: A Century of Trade Policy Shifts

- The Rise of Free Trade and the Decline of Tariffs: 1945 to 2000

- The Tariff Comeback: Why Tariffs Returned as a Political Weapon in the 21st Century

Trump Tariffs Deep Dive: Trade Wars with the EU, China, and Beyond

- Trump’s Tariff Strategy: National Security or Economic Gamble?

- EU Under Pressure: Wine, Steel, and the Automotive Tariff Threat

- The U.S.-China Trade War Timeline: From Tariff Waves to Tech Decoupling

- Collateral Damage: How Trump Tariffs Affected Mexico, Canada, India, and Japan

Country-by-Country Response Monitoring: Reactions to Trump’s 2025 Tariff Hike

- China Strikes Back: Export Controls, Rare Earths, and Consumer Tech Retaliation

- European Union’s Balancing Act: Strategic Patience or Trade Fight Ahead?

- Japan and South Korea: Strategic Allies or Silent Rivals in Tariff Diplomacy?

- ASEAN & India: Winners or Losers in the Tariff Shuffle?

- South America’s Role in a Polarized Trade World

Ongoing Monitoring and News Reaction: Tracking Trump’s Tariffs in Real-Time

- Week-by-Week: The Global Market Reaction to Trump’s 2025 Tariff Policy

- U.S. Companies Caught in the Crossfire: How Businesses Are Adjusting to Tariff Shocks

- From Retail to Rare Earths: Key Sectors Most Affected by New Tariffs

- Trade Talks Tracker: Are New Negotiations a Signal of Resolution or More Chaos?

- Inside the Beltway: How Congress, Lobbyists, and Think Tanks are Shaping the Tariff Narrative