In 2025, the Trump administration is considering imposing a 30% tariff on rare earth minerals and magnet components imported from China. This move is part of a broader strategy to address national security concerns. It also reduces the United States’ dependence on a single supplier for critical materials. Rare earth elements are essential for various high-tech applications, including defense systems, renewable energy technologies, and consumer electronics. Explore the implications of the Trump administration’s proposed 30% tariff on Chinese REEs imports, its impact on global supply chains.

The proposed tariff reflects the administration’s commitment to reshaping trade policies to prioritize domestic production and secure supply chains. This blog delves into the latest developments, real facts and figures, expert industry perspectives, and commentary from Mattias Knutsson—a strategic leader in global procurement and business development.

The Importance of REEs

Rare earth elements (REEs) are a group of 17 metallic elements crucial for manufacturing a wide range of products. Also, their unique magnetic, luminescent, and electrochemical properties make them indispensable in various industries.

Key Applications of REEs:

- Defense: Guided missiles, jet engines, advanced radar systems, night vision equipment, and stealth technologies.

- Energy: Wind turbines, electric vehicle (EV) motors, and high-efficiency batteries.

- Electronics: Smartphones, computer processors, semiconductors, and flat-screen TVs.

- Medical: MRI machines, PET scanners, and surgical lasers.

China currently dominates the global rare earth market, accounting for approximately 80% of the world’s production and refining capacity. This dominance has raised concerns about supply chain vulnerabilities, especially in times of geopolitical tension or economic retaliation.

The Proposed 30% Tariff: Objectives and Implications

The Trump administration’s proposed 30% tariff aims to achieve several objectives:

- National Security: Reducing reliance on Chinese REEs ensures that the U.S. military and critical industries have secure, uninterrupted access to strategic materials.

- Economic Strategy: Encouraging domestic production and processing of REEs could strengthen American manufacturing, create jobs, and reduce trade deficits.

- Trade Leverage: Tariffs are being used as a negotiating tool to push China toward concessions in ongoing trade talks, particularly around intellectual property and state subsidies.

Potential Implications:

- Supply Chain Disruptions: Industries dependent on REEs—especially defense, clean energy, and electronics—may face increased costs, procurement delays, or the need for substitute materials.

- Investment in Domestic Capabilities: The tariff could trigger a wave of government and private-sector investment in REE mining, refining, and recycling infrastructure within the U.S.

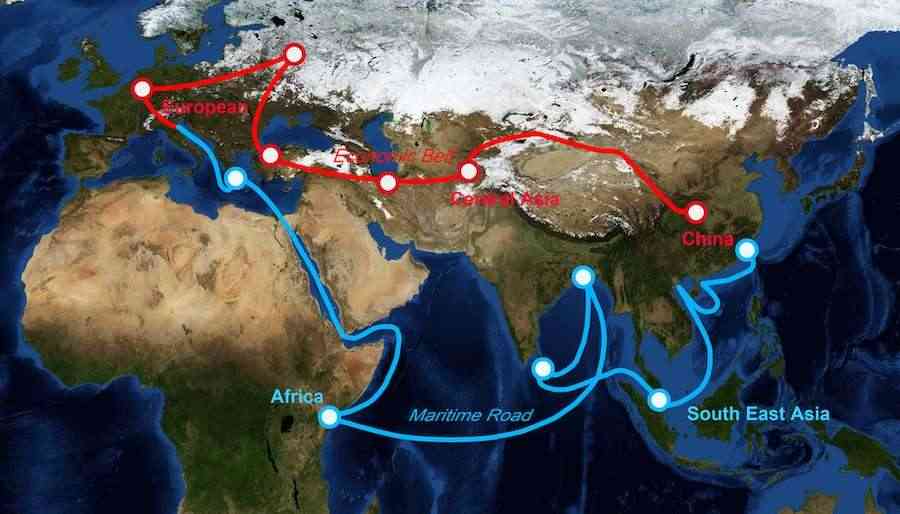

- Global Market Shifts: Countries like Australia, Canada, and Vietnam may expand their rare earth industries to fill the gap, potentially reshaping global trade alliances.

Real Facts and Figures

- U.S. Dependence: As of early 2025, the United States imports about 78–80% of its rare earth elements and components from China, with minimal domestic refining capacity.

- Global Production: In 2024, China produced approximately 140,000 metric tons of REEs, far ahead of the U.S. (38,000) and Australia (22,000), according to the U.S. Geological Survey.

- Price Volatility: The mere announcement of potential tariffs in April 2025 triggered a 12% spike in neodymium prices. Also with an 18% increase in dysprosium spot prices.

- Investment Highlights: U.S.-based MP Materials received over $500 million in federal and state funding between 2023–2025 to expand processing capabilities at the Mountain Pass facility in California.

Global Responses and Alternative Sources

Moreover, in response to potential U.S. tariffs and increasing concerns about overreliance on China, several countries and regions are rapidly diversifying their rare earth supply strategies:

Australia

- Investing in advanced refining facilities and forming supply agreements with U.S. and Japanese companies.

- Home to Lynas Rare Earths, one of the few non-Chinese companies operating at scale.

Canada

- Developing partnerships with European automakers to co-invest in REE mining and processing operations.

- Quebec and Ontario have emerged as new hotspots for rare earth exploration.

European Union

- Created a Critical Raw Materials Act in 2024 to mandate strategic stockpiling and support domestic extraction.

- Funding recycling projects to reclaim REEs from e-waste and industrial scrap.

Southeast Asia and Africa

- Countries like Vietnam, Myanmar, and Malawi are emerging as potential sources, though concerns about labor rights, environmental protections, and political instability remain.

Mattias Knutsson’s Perspective

Mattias Knutsson, a strategic leader in global procurement and business development, emphasizes that companies must adapt now rather than later to avoid being caught in the crossfire of future tariffs or export bans.

“The proposed tariffs underscore the need for companies to reassess their supply chains and invest in diversification. Building resilience is not just about mitigating risks but also about seizing new opportunities in emerging markets.”

Knutsson’s Recommendations for Global Firms:

- Supply Chain Mapping: Audit current supplier networks for rare earth exposure and dependencies. Identify choke points.

- Diversification: Proactively explore alternative sourcing options, including domestic production, secondary markets (recycling), and trusted international partners.

- Investment in Innovation: Allocate R&D toward REE substitutes (e.g., ferrite magnets), recovery technology, and low-impact extraction processes.

- Policy Engagement: Engage with regulators to influence favorable policies that support ethical sourcing, sustainable mining, and tariff incentives.

“Procurement is no longer transactional—it’s strategic. Tariff volatility, ESG mandates, and geopolitical shifts make it clear that resilience is the real competitive advantage in 2025 and beyond.”

Navigating the Future of Chinese REEs Imports

The Trump administration’s consideration of a 30% tariff on Chinese rare earth imports marks a significant development in U.S. trade policy, reflecting broader concerns about national security and economic independence. While the move aims to bolster domestic capabilities and reduce reliance on a single supplier, it also presents short-term challenges for industries and long-term shifts in global trade dynamics.

Companies must proactively adapt to these changes by diversifying supply chains, investing in domestic production and recycling technologies, and partnering with nations that share strategic and environmental values.

As Mattias Knutsson highlights, resilience, foresight, and collaborative innovation will be the key pillars of success in this evolving trade environment. Moreover, stakeholders who treat this moment as a call to action—not just a policy headline—will be best positioned to lead in the new rare earth economy.