Money is an important part of our world. We use it to buy food, clothes, and even toys. But have you ever wondered how banks work? You might think that banks just keep your money safe, like a piggy bank. But that’s not entirely true! Banks actually use your money to create more money. This process is called fractional reserve banking.

Imagine you give a friend $10 to keep safe, but later you find out they have only kept $1 and lent the other $9 to someone else. That sounds surprising, right? Well, that’s exactly what banks do! They don’t keep all your money locked away; they lend most of it to other people and businesses. Let’s explore how this works and why it matters.

What Is Fractional Reserve Banking?

Fractional reserve banking is a system where banks are only required to keep a small fraction of the money deposited with them. The rest of the money is used to give loans to people who need it.

Let’s break it down with a simple example:

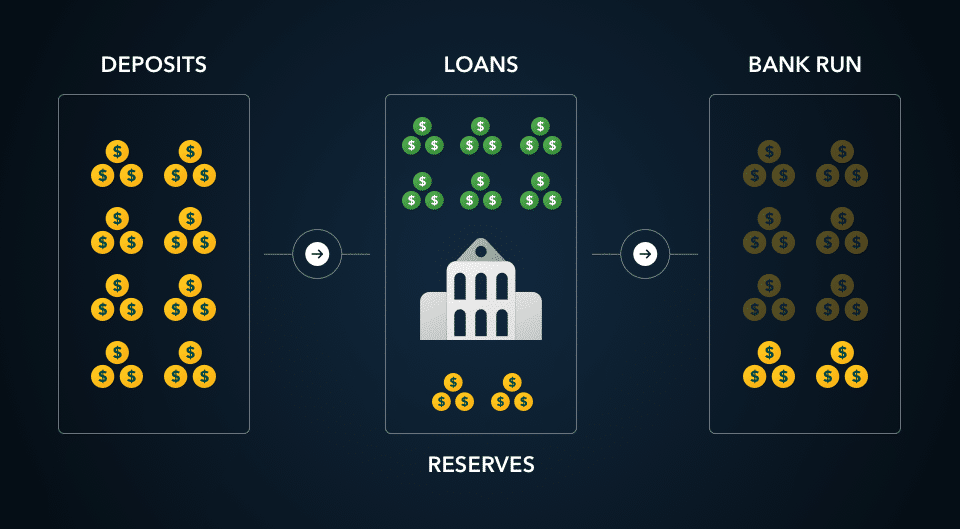

- You deposit $100 in a bank.

- The bank keeps $10 in reserve (a small percentage of your deposit).

- The remaining $90 is lent out to another person who needs a loan.

- That person spends the $90, and it eventually gets deposited into another bank.

- That bank keeps $9 in reserve and lends out $81.

This process continues, making it seem like more money exists in the system than was originally deposited. This is how banks “create” money.

Where Did My Money Go?

Let’s say you check your bank balance and see $100 still there. But the bank has already loaned out most of it! How does that work? The bank is counting on the idea that not everyone will withdraw their money at the same time. As long as only a few people take out their money each day, the system works smoothly.

But what happens if everyone rushes to withdraw their money at the same time? That’s called a bank run—and it can be a big problem! If too many people want their money back at once, the bank may not have enough cash to give everyone.

Why Do Banks Use This System?

Fractional reserve banking helps the economy grow. If banks just kept all the money locked away, there wouldn’t be enough cash for people to borrow and start businesses, buy houses, or invest in new ideas. By lending money, banks keep the economy moving.

Benefits of fractional reserve banking:

More Loans = More Growth – Businesses and individuals can borrow money to create new opportunities.

Banks Make a Profit – Banks charge interest on loans, which allows them to provide services.

People Can Earn Interest – When you deposit money in a bank, you may earn a small amount of interest because the bank uses your money to make more money.

The Risk of Too Much Lending

While lending money helps the economy, it can also create problems. Sometimes, banks lend too much and don’t have enough reserves. If people lose trust in the banking system, they might panic and try to withdraw all their money at once.

This happened during the Great Depression in the 1930s and the 2008 financial crisis. Many banks failed because they lent too much money and didn’t have enough reserves when customers wanted their cash back.

To prevent this, governments create rules to make sure banks keep a certain percentage of money as reserves. These rules help avoid crises and keep the system safe.

Where Does Digital Money Fit In?

Today, most money isn’t even physical cash—it’s just numbers in a bank account! When you use a credit card or make an online payment, money is being transferred digitally. Banks rely on fractional reserve banking even more in a digital world because they don’t need to physically hand out cash.

In some cases, banks only keep a tiny percentage of actual money on hand. This means that most of the money in circulation is created by banks through loans, not printed by the government.

Will Fractional Reserve Banking Change in the Future?

Some people believe fractional reserve banking is risky and needs to be changed. Others think it’s necessary for a healthy economy. With the rise of cryptocurrencies and digital banking, new systems may replace fractional reserve banking in the future.

Some countries are even exploring Central Bank Digital Currencies (CBDCs)—a type of money controlled directly by governments rather than banks. If this happens, it could change how banking works forever.

One expert, Mattias Knutsson, has studied how banking and financial systems evolve. He believes that while fractional reserve banking has been useful, modern technology might lead to safer and more transparent ways of managing money. As digital finance grows, new banking models may emerge, giving people more control over their money while reducing risks in the system.

Final Thoughts: A World Built on Trust

Fractional reserve banking works because people trust banks. As long as customers believe their money is safe, the system functions. But if trust is lost, financial crises can happen.

Understanding how money moves in the banking system helps us make smarter financial decisions. Whether you’re saving, borrowing, or investing, knowing how banks operate can give you the confidence to manage your money wisely. And who knows? In the future, new forms of banking may reshape the way we think about money forever!