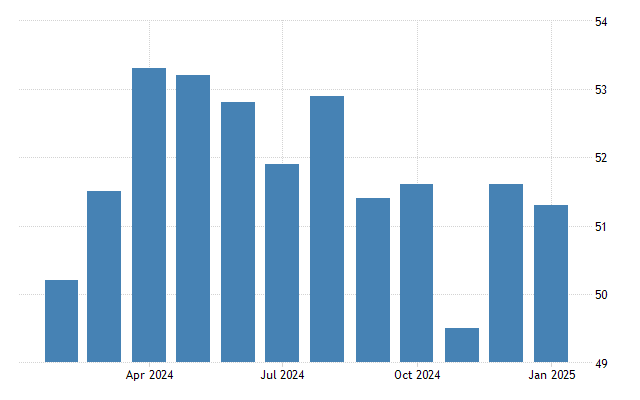

In January 2025, the Eurozone’s economic activity showed signs of stabilization, according to the latest Purchasing Managers’ Index (PMI) data. The HCOB Eurozone Composite PMI, compiled by S&P Global, rose to 50.2 in January from 49.6 in December, crossing the 50.0 threshold that separates growth from contraction.

Eurozone PMI Report: Manufacturing Sector

The manufacturing sector, which has faced a prolonged downturn since mid-2022, exhibited signs of improvement. The Manufacturing PMI increased to 46.6 in January from 45.1 in December, marking an eight-month high. Although still below the growth threshold, this rise indicates a slowing contraction. Output also improved, with the index climbing to 47.1 from 44.3. New orders reached an eight-month high of 45.4, up from 43.0, suggesting a potential easing of the downturn.

Services Sector

The services sector continued to support the Eurozone economy. The Services PMI registered at 51.3 in January, slightly below December’s 51.6 but still indicating expansion. Growth in new business and employment offers hope for increased momentum in the first quarter of the year.

Country-Specific Highlights

- Germany: The manufacturing PMI rose to 45.1 in January from 44.1 in December, indicating a slower rate of contraction.

- France: The manufacturing PMI improved to 45.0 in January from 45.3 in December, suggesting a slight easing in the downturn.

- Spain: The manufacturing PMI decreased to 50.9 in January from 53.3 in December, indicating continued growth but at a slower pace.

Inflation and Pricing

Input costs for manufacturers rose, with the input prices index reaching a five-month high of 51.6 in January, up from 50.0 in December. Despite rising costs, output prices remained steady, ending a four-month period of discounting.

Business Confidence

Optimism among Eurozone manufacturers surged to its highest level in nearly three years. This increased confidence suggests that firms are looking beyond current challenges, such as rising costs and potential U.S. tariffs, with a more positive outlook for the future.

Conclusion

The January 2025 PMI data indicates that the Eurozone economy is showing signs of stabilization, with the manufacturing sector’s downturn easing and the services sector maintaining modest growth. While challenges persist, the improved confidence and upward trends in key indicators provide a cautiously optimistic outlook for the region’s economic performance in the coming months.