In March 2025, the global manufacturing sector exhibited modest growth, with the J.P. Morgan Global Manufacturing PMI rising to 50.6 from 50.1 in February, marking the highest level in eight months. This uptick indicates expansion in operating conditions, albeit with notable regional disparities.

Regional Performance Highlights

- United States: The S&P Global U.S. Manufacturing PMI march 2025 registered at 50.2, signaling marginal growth. However, the Institute for Supply Management (ISM) reported a decline to 49.0, indicating contraction. This divergence reflects mixed signals in the U.S. manufacturing landscape.

- China: The Caixin/S&P Global Manufacturing PMI increased to 51.2, the fastest pace in four months, driven by robust export orders and increased demand. This growth is partly attributed to U.S. importers accelerating purchases ahead of anticipated tariff hikes.

- Eurozone: The manufacturing sector showed signs of recovery, with output rising for the first time in two years. However, this improvement may be temporary, influenced by front-loaded orders in anticipation of new U.S. tariffs.

- Asia: Japan, South Korea, and Taiwan experienced declines in factory activity, reflecting the broader impact of impending U.S. tariffs and weakened global demand.

PMI March 2025 Key Indicators and Trends

- New Orders: Global new orders grew, with the index reaching 51.3, indicating increased demand.

- Employment: Employment continued to decline globally for the seventh consecutive month, with reductions in regions including China, Canada, the Eurozone, Mexico, and the UK.

- Input Costs and Prices: Input costs and selling price inflation accelerated, particularly impacting intermediate goods.

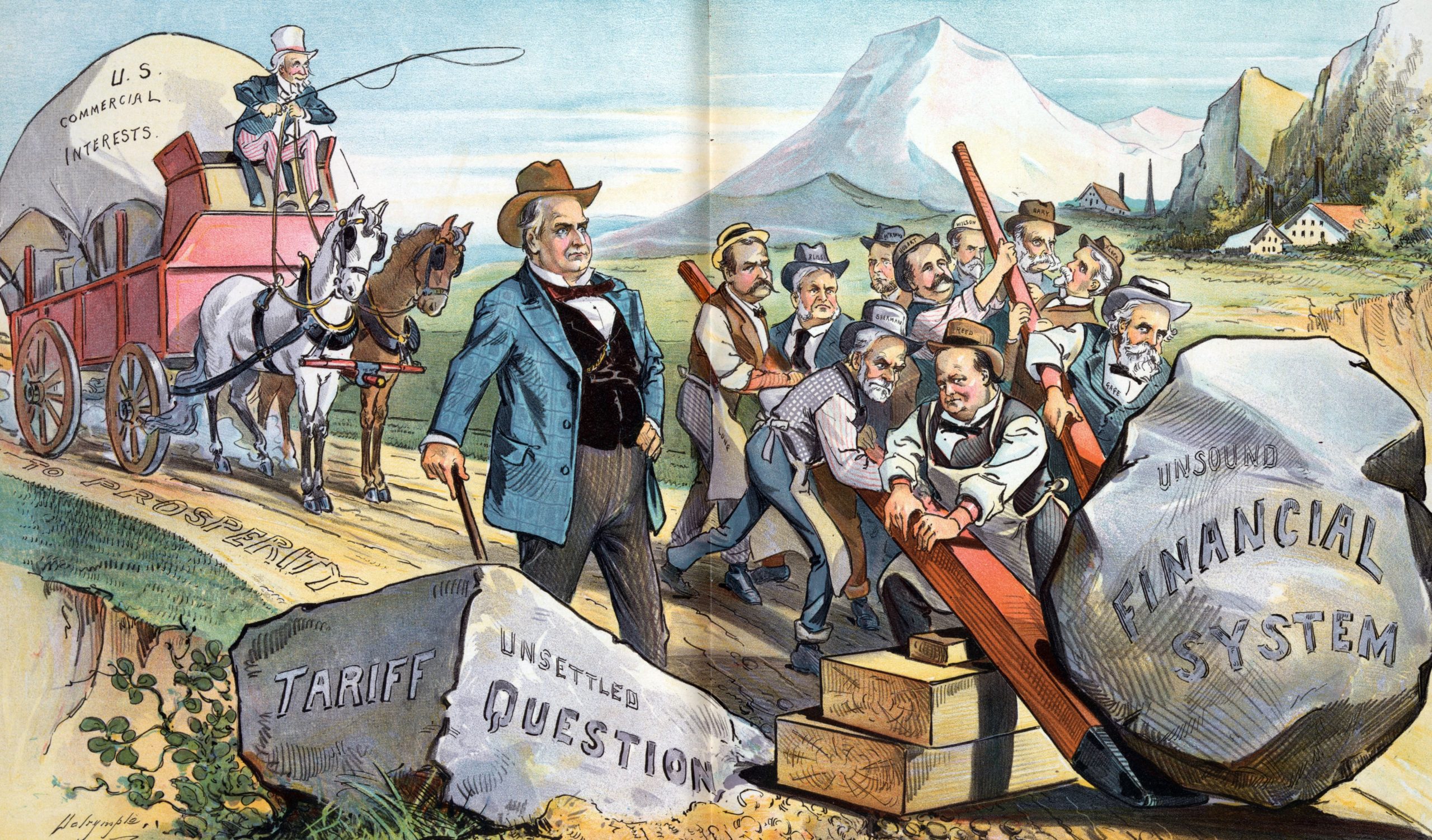

Impact of U.S. Tariffs

The anticipation of new U.S. tariffs, notably on aluminum, steel, automobiles, and all goods from China, has influenced global manufacturing dynamics. Businesses worldwide have accelerated production and shipments to preempt tariff impacts, leading to temporary boosts in activity. However, concerns persist about the sustainability of this growth once tariffs are implemented.

Outlook

While PMI March 2025 data indicates modest expansion in global manufacturing, the sector faces challenges ahead. The full impact of U.S. tariffs, potential supply chain disruptions, and varying regional performances will shape the manufacturing landscape in the coming months. Stakeholders should monitor these developments closely to navigate the evolving economic environment.