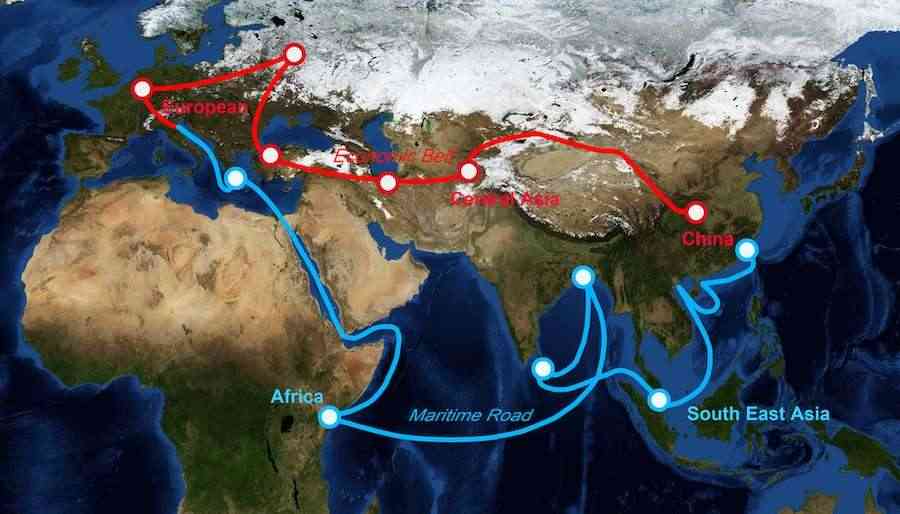

Launched in 2013, China’s Belt and Road Initiative (BRI) has redefined the scale of international development finance and connectivity. With projects spanning over 150 countries and investments exceeding $1 trillion, the BRI has become a central feature of China’s foreign policy and global influence. A forward-looking analysis of China’s Belt and Road Initiative in 2025—new directions, policy shifts, green investment, and expert insight.

But now, in 2025, the BRI is entering a new phase—one shaped by climate demands, debt rebalancing, digital expansion, and geopolitical recalibration. Nations that once eagerly signed on are reassessing their priorities. Meanwhile, China is recalibrating its approach to meet new global realities.

So, what’s next for this colossal initiative? This blog explores the evolving future of the BRI, backed by trends, real-world shifts, and analysis from global procurement strategist Mattias Knutsson.

Trend 1: Greening the Belt and Road (BRI) in 2025

Shift Toward Sustainability

Following President Xi Jinping’s 2021 pledge to halt overseas coal financing, China has doubled down on making the BRI more climate-conscious. As of 2025:

- Over 65% of new BRI energy projects are now renewable (solar, wind, hydropower).

- The Green Investment Principles (GIP) guide financial institutions involved in BRI projects.

- ESG (Environmental, Social, Governance) reporting has become mandatory for major BRI contracts.

Yet challenges persist. In some regions, legacy coal and oil investments still overshadow green transitions, especially where regulatory oversight is weak.

Trend 2: Debt Diplomacy Revisited

The global debt crisis prompted China to restructure or suspend over $78 billion in loans across 2023–2024. In 2025, we’re seeing:

- More public-private partnerships (PPPs) to reduce state debt burdens.

- Debt-for-nature swaps in Africa and Asia, where countries receive debt relief in exchange for conservation.

- A new focus on smaller-scale, locally anchored projects over megaprojects.

This recalibration is aimed at easing tensions and creating more mutually beneficial outcomes—but transparency remains a key concern.

Trend 3: The Rise of the Digital Silk Road

The Digital Silk Road (DSR) is now central to BRI expansion. Chinese companies are:

- Building 5G infrastructure in over 60 countries

- Exporting smart city and surveillance tech

- Launching satellite networks like BeiDou to rival GPS

This tech dominance offers connectivity—but raises questions about data sovereignty and cybersecurity.

Western competitors are responding with initiatives like the EU’s Global Gateway and the US-led Partnership for Global Infrastructure and Investment (PGII), pushing for open, ethical tech frameworks.

Trend 4: Strategic Diversification

China is shifting from high-profile projects to:

- Infrastructure maintenance and upgrades

- Logistics parks and cross-border e-commerce

- Health infrastructure (Health Silk Road)

- Education partnerships and digital skills training

BRI 2.0 is not just about building—it’s about sustaining, integrating, and localizing.

Countries that had been wary—like Italy, Malaysia, and Sri Lanka—are engaging more selectively, with conditional partnerships.

Trend 5: Regionalization of BRI in 2025

In 2025, the BRI is becoming more regionally adaptive. Rather than one-size-fits-all, China now works within local development strategies:

- In Africa, projects are increasingly tied to AfCFTA (African Continental Free Trade Area).

- In Southeast Asia, BRI corridors align with ASEAN master plans.

- In Central Asia, the focus is on multimodal logistics and security.

This approach is seen as a way to reduce backlash and improve project success rates.

Mattias Knutsson’s Insight: Strategy in an Interconnected World

Mattias Knutsson, a strategic voice in global procurement and development, views the BRI’s evolution as a critical turning point:

“The Belt and Road’s future depends not on how much is built, but on how well it endures. Success will be measured by shared ownership, adaptability, and transparency.”

He advocates for:

- Local capacity building to reduce dependency

- Stronger sustainability metrics in procurement

- Transparent governance as the baseline—not the exception

Knutsson warns that global projects like the BRI must evolve beyond ambition to deliver equity, resilience, and respect for local agency.

Conclusion:

As the Belt and Road turns 12 years old, its next chapter is more nuanced. Gone is the emphasis on grand symbolism. In its place: smarter investments, greener infrastructure, and a digital spine that may define the 21st century.

Whether China’s BRI remains the dominant development model will depend on how it responds to criticism, adapts to new realities, and builds trust with partners. For now, one thing is clear—the road ahead is no longer just about connecting cities. It’s about co-creating futures.