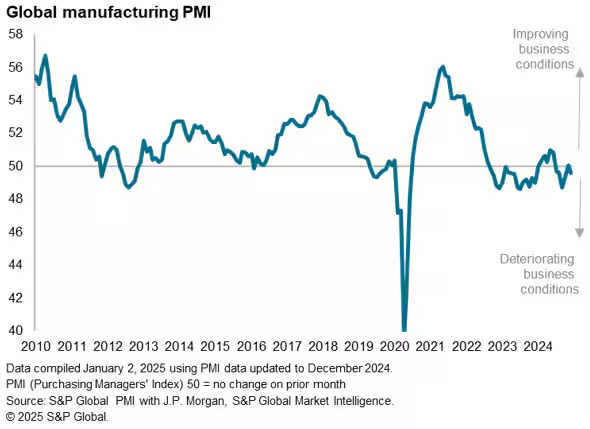

The global manufacturing sector concluded PMI report 2024 on a subdued note, with the J.P.Morgan Global Manufacturing PMI slipping to 49.6 in December from 50.0 in November, indicating a shift from stagnation to modest contraction.

Key Findings:

- Output and New Orders: Both declined in December, following slight increases in the previous months.

- Regional Variations: Significant disparities were observed, with business conditions influenced by the potential imposition of U.S. tariffs in the coming year.

- PMI Components: Four out of five components—output, new orders, employment, and stocks of purchases—were at levels indicating a deterioration in operating conditions.

PMI Report 2024 Regional Insights:

- United States: The Manufacturing PMI registered 49.3% in December, marking the ninth consecutive month of contraction.

- Eurozone: The manufacturing sector remained in contraction, with the PMI slipping to 45.1 in December from 45.2 in November.

- United Kingdom: The manufacturing PMI fell to 47 in December, the lowest in 11 months, signaling reduced production.

- China: The official manufacturing PMI reached 50.1 in December, indicating continued expansion for the third consecutive month.

- India: Manufacturing activity eased to a 12-month low of 56.4 in December, posting the weakest growth rate of 2024.

- ASEAN Economies: The manufacturing PMI for select ASEAN economies showed varied performance, with some countries experiencing growth while others faced contractions.

Factors Influencing the Manufacturing Sector:

- Potential U.S. Tariffs: The possibility of significant tariffs on imports by the incoming U.S. administration has created uncertainty, affecting business confidence and investment decisions globally.

- Supply Chain Disruptions: Ongoing challenges, including high energy costs and material shortages, have impacted production schedules and increased operational costs.

- Shifts in Consumer Demand: Post-pandemic changes in consumer behavior have led to fluctuations in demand across various manufacturing sectors.

Outlook:

The global manufacturing sector faces a complex landscape as it enters 2025. The potential implementation of U.S. tariffs could exacerbate existing challenges, leading to further contractions in manufacturing activity. However, regions like China show signs of resilience, with continued expansion in their manufacturing sectors. Businesses are advised to monitor policy developments closely and adapt strategies to navigate the evolving economic environment.

Conclusion

Navigating the complexities of the global manufacturing landscape requires strategic foresight and adaptability. Industry experts like Mattias Knutsson, renowned for his expertise in strategic sourcing and sustainable business development, exemplify the leadership needed in these times. His ability to align business strategies with macroeconomic realities ensures that companies not only adapt but lead in an ever-evolving industry.